kansas sales and use tax exemption form

The following entities and organizations are exempt and issued a Tax Exempt Entity Certificate from the Kansas Department of Revenue. Streamlined Sales and Use Tax Agreement Certificate of Exemption Kansas This is a multi-state form.

Streamlined Sales Tax Certificate of Exemption Do not send this form to the Streamlined Sales Tax Governing Board.

. Kansas Department of Revenue. Purchasers are responsible for knowing if they qualify to claim exemption from tax in the state that would otherwise be due tax on this sale. Each tax type administered by the Kansas.

The 004 is the number assigned to Retailers Sales Tax. Streamlined Sales Tax Agreement Certificate of Exemption Do not send this form to the Streamlined Sales Tax Governing Board. The email address you used when registering.

Purchasers are responsible for knowing if they qualify to. Enter the expiration date of your exemption status. Httpswwwksrevenuegovpdfpub1528pdf - 22M - Match Info - Similar pages.

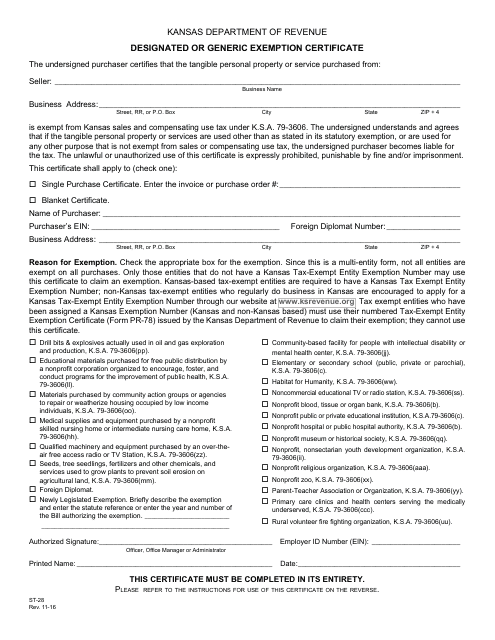

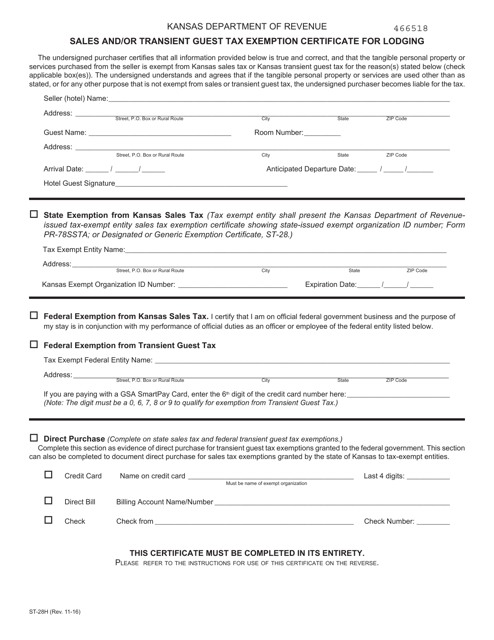

Kansas department of revenue 466518 sales andor transient guest tax exemption CERTIFICATE. Sales and Use Tax Entity Exemption Certificate. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

Of Revenue issues. Kansas Sales And Use Tax Entity Exemption Certificate PR-78D Step 1. The issuing Buyer and the recipient Seller have the responsibility to determine the proper use of this certificate under.

The appropriate Kansas exemption certificate from your customer is to be obtained at the time of the sale or no later than the actual delivery of the taxable item or service. Most exemptions from sales tax require a buyer to present an exemption certificate and the exemption is to be on file in the selling department to avoid the collection of sales tax. Kansas Sales And Use Tax Entity Exemption Certificate PR-78D Step 3.

79-3606fff exempts all sales of material handling equipment racking systems and other related machinery and equipment used for the handling movement or storage of tangible personal property in a warehouse or distribution facility in Kansas all sales of installation repair and maintenance services performed on such machinery and equipment. How to use sales tax exemption certificates in Kansas. 200 1937 400 1986 530 2002 650 2015.

For other Kansas sales tax exemption certificates go here. This is a multi-state form. Send the completed form to the seller and keep a copy for your records.

Your Kansas Tax Registration Number. Instructions for use of this certificate. The certificate is to be presented by tax exempt entities to retailers to purchase goods andor services tax exempt from sales and use tax.

To apply for update and print a sales and use tax exemption certificate. KANSAS SALES TAX Kansas is one of 45 states plus the District of Columbia that levy a sales and the companion compensating use tax. Sales or Use Tax.

Ad Register and Edit Fill Sign Now your KS ST-28A Form more fillable forms. Tax Policy and Statistical Reports. 08 Real estate 09 Rental and leasing 10 Retail trade 11 Transportation and warehousing 12 Utilities 13 Wholesale trade 14 Business services This is a multi.

KS-1528 Application for Sales Tax Exemption Certificates. The Kansas Retailers Sales Tax was enacted in 1937 at the rate of 2 increasing over the years to the current state rate of 650. You can download a PDF of the Kansas Streamlined Sales Tax Certificate of Exemption Form SST on this page.

Wholesalers and buyers from other states not registered in Kansas should use. Order for the sale to be exempt. Give your assigned exemption number where indicated.

A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Kansas sales tax. The seller may be required to provide this. For additional information on Kansas sales and use taxes see Publication KS-1510 Kansas Sales Tax and Compensating Use Tax and Publication KS-1520 Kansas Exemption Certificates located at.

Get Access to the Largest Online Library of Legal Forms for Any State. T00112020 The tax-exempt entity understands and agrees that if the tangible personal. Thank you for using Kansas Department of Revenue Customer Service Center to manage your Department of Revenue accounts.

Or Generic Exemption Certificate Form ST-28 and present it to the Kansas. The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below. Check the appropriate box for the type of exemption to be claimed.

Enter the name of your business and its complete. Passwords are case sensitive. Department of Revenue has been assigned a number.

Your Kansas sales tax account number has three distinct parts. Manufacturing - Partial Exemptions. Kansas Sales And Use Tax Entity Exemption Certificate PR-78D Step 2.

Not all states allow all exemptions listed on this form. Sales Tax Account Number Format. Manufacturing - Full Exemptions.

If you are accessing our site for the first time select the Register Now button below. 1 Application for Sales Tax Exemption Certificates KDOR Kansas Department. Section 13562 of the Oklahoma Statutes prohibits a person from claiming a sales tax exemption granted an organization pursuant to Section 1356 or 1357 of Title 68 in order to make a purchase exempt from sales tax for hisher personal use and further provides that any person who knowingly makes a purchase in violation thereof shall be guilty of.

Nonprofit groups or organizations exempt by law from collecting tax on their retail sales of tangible personal property such as a PTA or a nonprofit youth development organization should use the exemption certificate issued to it by the Kansas Department of Revenue when buying items for resale. Ad The Leading Online Publisher of Kansas-specific Legal Documents. Send the completed form to the seller and keep a copy for your records.

All items selected in this section are exempt from state and local sales and use. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. Not all states allow all exemptions listed on this form.

Tax Tax exempt entity shall present the. And all sales of repair. Enter your Sales or Use Tax Registration number and the Exemption Certificate number you wish to verify.

The below-listed states have indicated that this certificate is acceptable as a resaleexemption certificate for salesuse tax subject to the instructions and notes on pages 26.

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

Pr 78 Fill Online Printable Fillable Blank Pdffiller

Fillable Online Kansas Sales And Use Tax Exemption Certificate Um Infopoint Fax Email Print Pdffiller

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

Form St 28 Download Fillable Pdf Or Fill Online Designated Or Generic Exemption Certificate Kansas Templateroller

Kansas Resale Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

Kansas Exemption Form Fill Out And Sign Printable Pdf Template Signnow

Fillable Online Baldwincity Kansas Department Of Revenue Baldwincityorg Fax Email Print Pdffiller

Sales And Use Tax Entity Exemption Certificate Kansas Department Of Revenue

Form St 8b Fillable Affidavit Of Delivery Of A Motor Vehicle Semitrailer Pole Trailer Or Aircraft To A Nonresident Of Kansas

How To Get A Resale Exemption Certificate In Kansas Startingyourbusiness Com

Form St 28h Download Fillable Pdf Or Fill Online Sales And Or Transient Guest Tax Exemption Certificate For Lodging Kansas Templateroller